Most buyers say they “understand” amortization because they’ve heard it before and know it involves loan payments. However, understanding the meaning and how it can affect your loan over time is vital to ensuring you have secured the best financing option.

Amortization can be intimidating.

Let’s break it down a bit.

What does amortization mean?

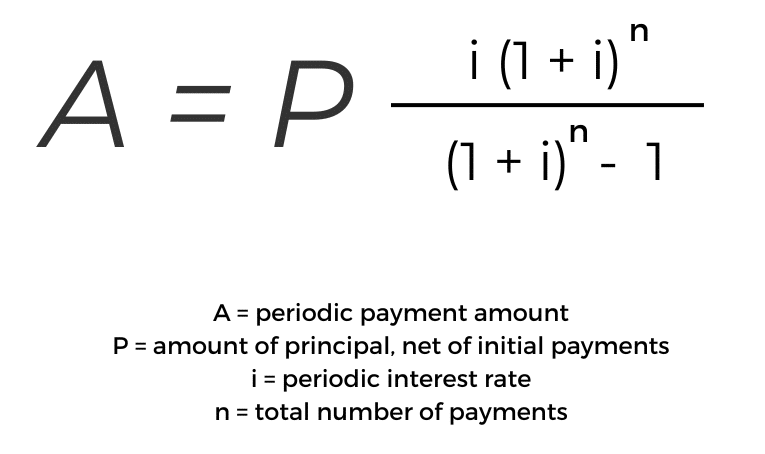

By definition, amortization is the process of gradually paying down the initial cost of an asset or paying off a debt with regular payments. Think of amortization as spreading out loan payments over time (usually 60 months for heavy construction equipment). It is common for the amortization to match the term amount. If you have a 60-month term, your amortization schedule will often be 60 months long. It is important to note that the term (number of payments you will make) and amortization (repayment period/period over which your payments are spread) can differ depending on your financing agreement.

An amortization schedule shows the loan balance as interest and principal payments made each month. Your amortization schedule changes based on the terms of your loan. Most likely, you’re familiar with this schedule from financing your home—same concept here.

A few phrases that are helpful to know:

Term: A five-year term is standard for heavy equipment, which you will see in our fist example. Bevel Financial can help you achieve a different term, which you will see shown in our second example.

Interest Rate: An interest rate can vary anywhere from 7-14% (as of this writing) depending on a myriad of factors:

- Who is funding the loan

- Your credit score

- Cash flow

- What you’re financing

Types of Interest Rates:

- Fixed interest rate means your interest is the same throughout the loan.

- Variable interest rate means the rate changes throughout the life of the loan. It fluctuates based on an index lenders use to set their rates.

Balloon Payment: If your loan has a longer amortization than the term, you will have an outstanding principal balance, or balloon payment, at the end of the term. This is common for commercial real estate loans where a 5-year term and 20-25-year amortization is standard. The most common way to handle this balloon is to refinance it into a new term, but you also have the option to pay the note off using cash or sale proceeds.

We will show you a fixed interest rate loan, typical for a construction equipment loan.

If you were to apply for a $100,000 loan with an 8% fixed interest rate over a five-year term with five-year amortization (60 months), your payment schedule would look like this:

Financed Amount: $100,000

Monthly payment (60): $2,027.64

End-of-term balloon payment: $0

At the end of the term, your loan balance would be $0, and your equipment would be paid in full. The loan structure above is the most common approach to financing construction equipment.

Longer Terms and Amortization

The Bevel Financial team focuses on aligning financing with the actual useful life of the financed equipment. A traditional lender will tell you that it’s five years for construction equipment when it’s much longer than that.

According to ConEquip , most heavy construction equipment will last anywhere from 6,000-12,000 hours, commonly equating to about ten years if properly cared for. Most mixed-use construction equipment (aerial, earth moving, and material handling) has a useful life of up to 20+ years when well maintained.

Because the Bevel team has a deep knowledge of heavy construction equipment, we can work directly with lending partners to achieve longer amortizations that more appropriately match the useful life of your equipment purchase.

Below is an example of what an amortization schedule looks like for a $100,000 loan with an 8% fixed interest rate over a 7-year term with 7-year amortization (84 months). Your payment schedule would look like this:

Financed Amount: $100,000

Monthly payment (84): $1,558.62

End-of-term balloon payment: $0

You will notice that by extending your loan’s term to match the equipment’s useful life, your monthly payments decrease by 23%. That’s 23% less in debt payments you’re making every month, meaning more cash in hand, and you still own the equipment outright at the end.

A longer term and amortization period means:

- Lower monthly payments

- More monthly cash flow

- Aligning your financing with the actual useful life of your heavy equipment

Why partner with Bevel Financial?

Because there are so many factors when it comes to lending and each individual’s situation is truly unique, there’s no one-size-fits-all method. Our team will work for you to simplify and accelerate your financing process.

By partnering with Bevel, we assess each lending solution through the lens of your unique situation. Get a lender focusing on what’s best for your business’s cash flow, long-term financial planning, and required annual financing needs.

Our team is your advocate in the commercial lending marketplace with the sole goal of finding the most suitable terms for your business. You get a capital markets desk in-house and only pay us for success.

We have partnerships with banks, lenders, credit unions, and more to compare opportunities for you. This is especially important during periods of economic uncertainty when institutions are more selective about the financing they provide.

Bevel’s established partnerships decrease the financing timeline by about ten days.

How do you make the right lending choice?

Reach out to the Bevel Financial team today to get a quote for your financing request and discuss your upcoming financing needs. We are here to help you every step of the way.